As one of the largest banks in the United States, Wells Fargo has over 13,000 ATMs and 5,400 retail banking locations across the country.

If you’ve moved around a lot and still have a Wells Fargo account, it can get tricky to find your routing number. You might need it to set up a direct deposit, get a paycheck deposited, transfer funds, or any number of financial tasks. It can be a pain to look it up but not today.

If you’re looking for your Wells Fargo routing number, we can help you find it.

There are three easy ways you can find it:

- Look up your routing number by state

- Look for your routing number on your personal checks, if you have one available

- Call Wells Fargo customer service and ask them for your routing number

Let’s dive right in:

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Wells Fargo Routing Number by State

Your Wells Fargo ABA routing number will be based on the state in which you opened your account, just look for it on the table below and you’re done.

| State | ABA Routing Number |

|---|---|

| Alabama | 062000080 |

| Alaska | 125200057 |

| Arizona | 122105278 |

| Arkansas | 111900659 |

| California | 121042882 |

| Colorado | 102000076 |

| Connecticut | 021101108 |

| Delaware | 031100869 |

| Florida | 063107513 |

| Georgia | 061000227 |

| Hawaii | 121042882 |

| Idaho | 124103799 |

| Illinois | 071101307 |

| Indiana | 074900275 |

| Iowa | 073000228 |

| Kansas | 101089292 |

| Kentucky | 121042882 |

| Louisiana | 121042882 |

| Maine | 121042882 |

| Maryland | 055003201 |

| Massachusetts | 121042882 |

| Michigan | 091101455 |

| Minnesota | 091000019 |

| Mississippi | 062203751 |

| Missouri | 113105449 |

| Montana | 092905278 |

| Nebraska | 104000058 |

| Nevada | 321270742 |

| New Hampshire | 121042882 |

| New Jersey | 021200025 |

| New Mexico | 107002192 |

| New York | 026012881 |

| North Carolina | 053000219 |

| North Dakota | 091300010 |

| Ohio | 041215537 |

| Oklahoma | 121042882 |

| Oregon | 123006800 |

| Pennsylvania | 031000503 |

| Rhode Island | 121042882 |

| South Carolina | 053207766 |

| South Dakota | 091400046 |

| Tennessee | 064003768 |

| Texas | 111900659 |

| Texas – El Paso | 112000066 |

| Utah | 124002971 |

| Vermont | 121042882 |

| Virginia | 051400549 |

| Washington | 125008547 |

| Washington, D.C. | 054001220 |

| West Virginia | 121042882 |

| Wisconsin | 075911988 |

| Wyoming | 102301092 |

Why are there so many Wells Fargo routing numbers?

Ever wonder why some banks have so many routing numbers? It’s because they’ve merged and acquired smaller banks, keeping their financial infrastructure in place, and just building on top of it. Wells Fargo & Company was founded mid-1800s so they’ve had quite a bit of time to acquire other banks over the years.

You’ll notice in the list that many states have the same ABA routing number. Those were all one bank (or at least one bank at the time they were acquired) before Wells Fargo brought them into the fold. It’s fun to see the relationships of banks because you can often tie them back to their ABA routing number.

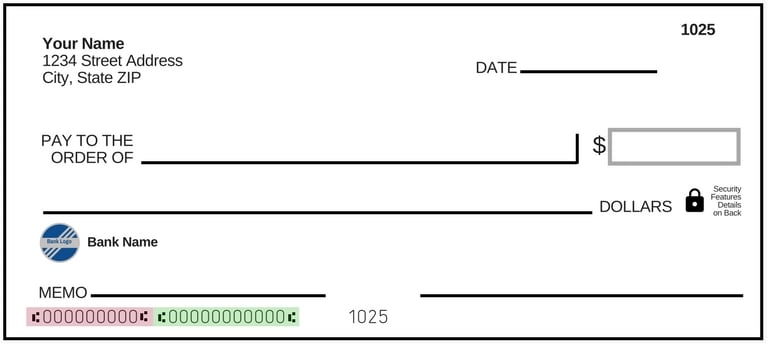

Finding the Routing Number on Your Check

If you have a personal check handy, your routing number is located on the check itself. This is why most HR departments request a voided check to set up your direct deposit. They want to be able to read it from the check itself, avoiding any lost-in-translation situations in case you write it down wrong.

The nine-digit number highlighted in red is the number you want to use. The green number, which is often longer, is your account number. The ABA routing number is always a nine-digit number and you can confirm the number with the table above or use the American Bankers Association Routing Number lookup tool to confirm.

What’s fun is that you can confirm the validity of any ABA routing number’s formatting with just the number itself. The first four digits correspond to the Federal Reserve Routing Symbol, the next four digits are the ABAB institution identifier, and the last digit is a check digit.

If you look at the California routing number (121042882) – the first four digits are for the Federal Reserve Routing Symbol. The 12 is for San Francisco. I won’t get into super detail about the rest but I think it’s kind of fun to see.

Contact Wells Fargo for Your Number

There are two ways you can ask Wells Fargo, the first is through a form on their website. It will ask you for your account type and state to determine your routing number. We pulled the numbers in the above table from this tool.

If you don’t recall which state you were in when you first opened the account and you don’t have a check, you can call Wells Fargo to ask a customer service representative for your ABA routing number.

The phone number is 1-800-869-3557 and they are available 24 hours a day, 7 days a week.

Different Routing Number for Wire Transfers

The ABA routing numbers are useful only for ACH transfers. If you are receiving a wire transfer, then the code will be different – fortunately, it’s a simpler system with one number for domestic wire transfers and one for international wire transfers.

Wire transfers are “better” than an ACH transfer because they’re faster by a few days – they’re also more expensive. An ACH transfer is free, an incoming wire transfer costs $15 and an outgoing transfer costs $30.

- Domestic wire transfer (Wire Routing Transit Number) – 121000248

- International wire transfer (SWIFT/BIC Code) – WFBIUS6S

If you’re receiving a wire transfer, here’s the other information you may need to provide:

| Bank Name | Wells Fargo Bank, N.A. |

| Bank Address | 420 Montgomery San Francisco, CA 94104 (regardless of where your account is located) |

| BNF/Field 4200 Beneficiary acct. # | Your complete Wells Fargo account number including leading zeros |

| Beneficiary account name and address | The name and address of your account as it appears on your statement |

| CHIPS Participant | 0407 |

If you’re going to send a wire transfer, confirm all the details before you send it. In almost all cases, wire transfers cannot be reversed. Always talk to the person you’re going to wire transfer, double-check the details, and confirm them. I’ve heard of a lot of scams that are the result of erroneous wire transfers.

There you go – pretty easy right?

Susan McGowan says

Very informative & helpful in deciding on a specific bank w/o extra fees for checking & yet convenient & accessible to me. Great thank you. Also found your investment choices interesting.