The billionaire Trump associate who bought Jordan F1 team — and turned a quick profit

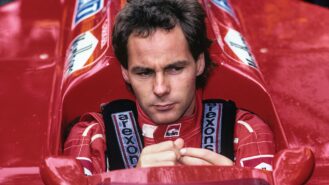

Lawrence Stroll isn’t the first Canadian billionaire at ‘Team Silverstone’. Two decades ago, Alex Shnaider bought what was then the Jordan team and revealed his plans to Matt Bishop in an initially uncomfortable interview