Scalextric launches 2025 range: Le Mans winners and Hollywood heroes slot in to new line-up

New race sets celebrating legendary motor sport moments, and 62 individual slot car models make up the newly-released Scalextric range for 2025

Legends of racing join Scalextric’s slot car line-up for 2025!

Race in the wheeltracks of Colin McRae; take on the Monte Carlo challenge with a trio of Mini Coopers; or go wheel to wheel with touring car icons. It’s all possible with Scalextric’s new 2025 range, which is available to pre-order now.

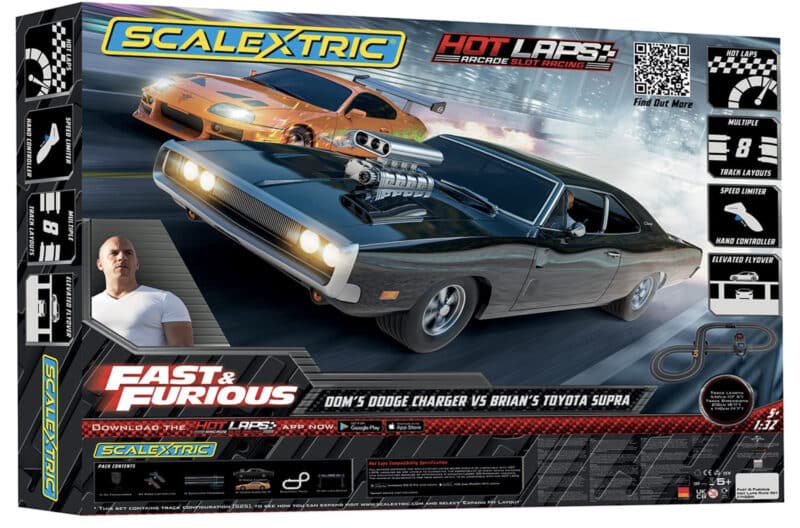

As well as some racing’s best known and loved cars, you’ll also find models from the big screen, including a flying DeLorean from Back to the Future, a series of Fast and Furious models, including Brian O’Conner’s drift-happy Toyota Supra and Dominic Toretto’s Dodge Charger in a new Hot Laps set, plus the Plymouth Barracuda from John Wick Chapter 4.

That’s just the start. You can explore the full range of ten new multi-car race kits and 62 individual slot-car models at Scalextric’s New for 2025 page now

There are also plenty of options from the existing line-up, available for delivery now: suel with the 1980s’ dominant Ford Sierra RS500 touring cars from the Super Sierras Retro Race Set, or battle it out with modern F1 cars in the Williams Racing Race Set.

We’ve joined forces with Scalextric to create this exclusive racing hub, telling the thrilling story of some of these racing icons from across the range, along with full details of these latest innovative 1:32 scale sets from the home of slot car racing.

New race sets celebrating legendary motor sport moments, and 62 individual slot car models make up the newly-released Scalextric range for 2025

In the same year that Ford has announced its return to Le Mans’ top echelon, Scalextric has chosen to honour one of its most famous drivers. We look back on the cars that defined Ken Miles

Sponsored by Colin McRae made legends of the cars that he took sideways through the dense forests and gravel roads that made up some of the world’s fiercest rally…

• Toyota Supra & Dodge Charger

• 15 track piece

• Combine the best of slot racing and arcade gaming with checkpoint racing app

Williams was in a sorry state compared to its 1990s glory days, but 2023 marked the start of a turnaround, with James Vowles leading the recovery. Now Carlos Sainz is set to join, alongside experienced technical boss Pat Fry and optimism is building…

Super Sierras Retro Race Set Racing fans can relive a golden era of the British Touring Car Championship following the launch this year of the Super Sierra Retro Race Set…

Sponsored by Williams remains one of Formula 1’s best-loved teams and will surely prove a popular choice for Scalextric, which has based its first modern-era F1 set for…

Forty years ago Frank Williams left the company he’d lost and started again – in an old carpet warehouse his friend Dave Brodie had found for him, with a second-hand…

The team that carries his name will race on, but an enormous link to Formula 1’s past was lost yesterday when Sir Frank Williams passed away at the age of…

Williams is one of F1’s most successful teams, but hasn’t won in a long time – its principal James Vowles explains why the approach of Frank and Patrick won’t work in the modern age, and how he’s doing things differently

• Lap counter

• 4 track layouts

• Magnatraction system for extra traction and downforce

From the Bathurst 1000 to the Fuji Speedway, the Ford Sierra RS500 was comprehensively dominant in its heyday — and its drivers enjoyed every second behind the wheel

It’s July 1988 and I’m at Brands Hatch, waiting impatiently between Druids and Graham Hill Bend for the manic pack of RS500 Cosworths, E30 M3s and assorted Class C and…

What comes to mind when you think of the greatest competition car ever – the McLaren MP4/4? The Ferrari 500? Porsche 956/962? Or is it an everyday family car that…

It was a rush job, putting it mildly. Demand from teams wishing to convert race Cosworths to RS500 specification was overwhelming and the process couldn’t start until Ford had built…

When Ford invited motoring writers to drive the Sierra RS Cosworth in Spain last December, the occasion immediately passed into lore. Nobody was prepared for so much excitement and for…

In most branches of professional motor sport, the man who is doing the driving is not the same as the man who is doing the engineering back at the workshop.…

• Working lights

• Magnatraction system for extra traction and downforce

• Flyover section