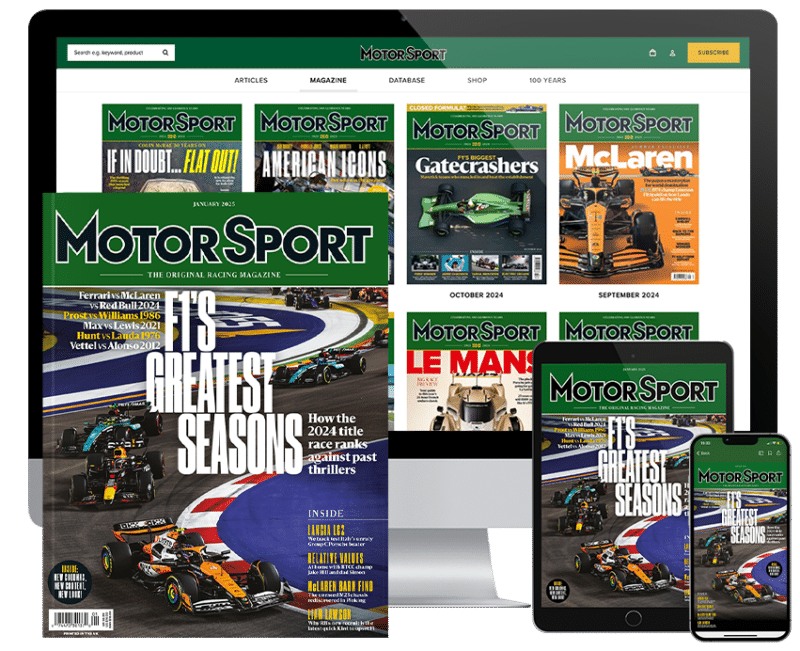

Bundle

Print & digital issues plus website

- Monthly print magazine

- Digital edition via web & app

- Unlimited website access

- Archive dating back to 1924

- Database featuring drivers, teams, circuits and races

- Digital special editions featuring historic races, legends and car marques

- The latest news, analysis and race reports