How can you tell if a certificate of authenticity is real?

Signed racing memorabilia often comes with a certificate of authenticity? But how much should you trust it?

Here at The Signature Store we often get asked to authenticate items, usually either for valuation or ahead of sales, and that raises the sometimes thorny issue of COAs, or certificate of authenticity.

These can be iron-clad infallible proof that an item is the real deal or they can be a total Wild West. The issue is COAs differ hugely in quality and are largely unregulated with every seller having their own style and format. However, there are some key things to look for when buying an item that has a COA, or even when getting one yourself.

The gold standard is a photographic proof of signing. A COA that states the date, place and describes the item being signed, backed up with a photo of the signing, is about as good as it gets.

If you don’t have a COA, there are companies out there where you can send your items to them for authentication and pay to have a COA created. This can be expensive and not worth it for low-value items. These are usually based on a simple ‘opinion’ as to whether the item is real or not, and may not be backed up by expert knowledge or research.

Ideally the COA should have the name of the item and a description. It isn’t always possible to get a photo of an item being signed, but information about when and where adds confidence. If there is a photo, what does it show? Is it being signed in the right place? I find the fancier a COA is – embossed, with stamps and holograms – the closer you should pay attention. Be wary of anything over-elaborate. Is it trying to hide something?

Ultimately, judge any purchase on the item alone. Motor sport is living history and there are enough people around for almost everything to have a living link to a time or place. Also, never be afraid to speak to an expert as opinions should be free and can sometimes be far more valuable than any piece of paper.

Carpits track rugs

One for the kids, or those seeking to give their Hot Wheels collection some track mileage. These brilliant floor rugs are designed to mimic Monaco, Spa or Silverstone. The base has anti-slip dots to keep the rugs firmly in place. Here, take our money! Carpits, £60

Custom brick sets

There’s a growing trend for aftermarket Lego sticker and instruction sets. Check out @sfhbricks on Instagram, who creates Le Mans cars, like this 962. Instructions at Rebrickable; stickers at Brick Sticker Shop. Rebrickable; Brick Sticker Shop, instructions from £4.30, stickers from £7 rebrickable.com; brickstickershop.com

Levi’s x McLaren racing suit

If your next fancy dress theme is ‘1960s F1 mechanic’ then Levi’s has you sorted with its tie-up with McLaren. This 100% cotton one-piece in light indigo blue pays homage to the Bruce McLaren era with retro patches and classic racing Kiwi motifs. Levi’s, £425

McLaren bodywork set

Speaking of McLaren, why not mark the Woking firm’s first Formula 1 Constructors’ Championship since 1998 with a true collectible? This set includes a piece of race-used bodywork from both Lando Norris’s and Oscar Piastri’s MCL38s. F1 Authentics, £749

BMW Carbon Filler Cap

Add some GT3 to your 3 Series. This pure carbon-fibre cap fits direct over the dull old plastic filler. Probably the most stylish accessory nobody will see due to it spending most of its life beneath the bodywork. But you’ll know it’s there. BMW Shop, £91.50

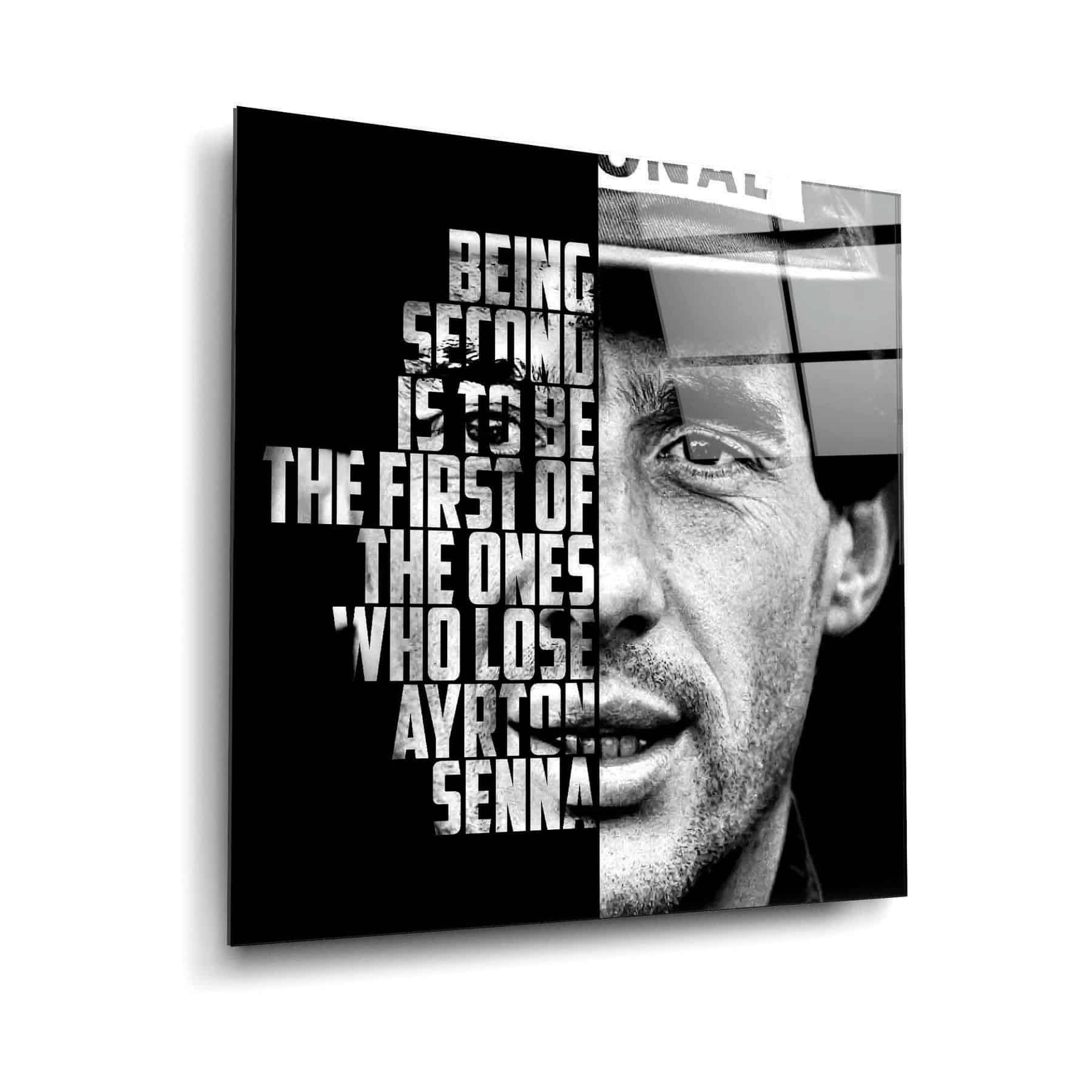

Senna glass art

Upgrade your wall-hanging game with an ultra-modern frameless glass print. This one features a half-profile of Ayrton Senna against one of the Brazilian’s famous quotes. Eye-catching and thought-provoking. Artdesigna, from £159.99

Andrew Francis is director at The Signature Store. thesignaturestore.co.uk