Did you know that TD Bank was founded in 1855? The TD in TD Bank stands for Toronto-Dominion – the name of the two banks that would eventually merge to form TD Bank.

The Bank of Toronto was founded in 1855 while The Dominion Bank opened its first branch in 1871. It wasn’t until 1919 that The Dominion Bank opened a branch in New York City. The two banks would merge in 1955.

Today, it’s a top 10 bank in North America and if you’re looking for a TD Bank routing number, it’s probably because you’re a customer.

Fortunately, finding your routing number is super easy and today we’ll explain exactly how to find it.

There are three really simple ways to find your routing number:

- Look up your ABA routing number by state

- Look for your ABA routing number on your personal checks

- Contact TD Bank and ask them for your routing number

Table of Contents

TD Bank Routing Number by State

Do you remember the state in which you opened your account? If so, you can look at the table below to find out your routing number.

If the state is not listed, it’s because TD Bank doesn’t have a presence there and so you couldn’t have opened an account. If you misremembered where you opened it, you’ll have to try another method.

| State | ABA Routing Number |

|---|---|

| Connecticut | 011103093 |

| Delaware | 031201360 |

| Florida | 067014822 |

| Maryland | 054001725 |

| Massachusetts | 211370545 |

| New Hampshire | 011400071 |

| New Jersey | 031201360 |

| New York (Metro), former Commerce customers | 026013673 |

| New York (Upstate), former BankNorth customers | 021302567 |

| North Carolina | 053902197 |

| Pennsylvania | 036001808 |

| South Carolina | 053902197 |

| Rhode Island | 211370545 |

| Vermont | 011600033 |

| Virginia | 054001725 |

| Washington, D.C. | 054001725 |

If you live in a state that isn’t on the list and opened your account online, you may have been assigned to a nearby state. In that case, you’ll need to use another method to find out your routing number.

Why are there so many TD Bank routing numbers?

Some banks have long list of routing numbers because they have acquired or merged with other banks. If you want to see a really long list, check out Wells Fargo’s massive list of routing numbers. TD Bank was founded nearly two hundred years ago so it makes sense that they’d have quite a few ABA routing numbers.

In fact, look at New York in the list above – there are two routing numbers. One is for former Commerce Bank customers who are primarily in the New York metro area and the other is for former BankNorth customers, which are in the upper part of the state. Those two merged to become TD Bank, N.A.

Finding the Routing Number on Your Check

If the state by state listing above didn’t help, you can always look directly on your personal checks. Each of your personal checks has all the information a bank would need to cash it – including the originating bank (it’s ABA routing number).

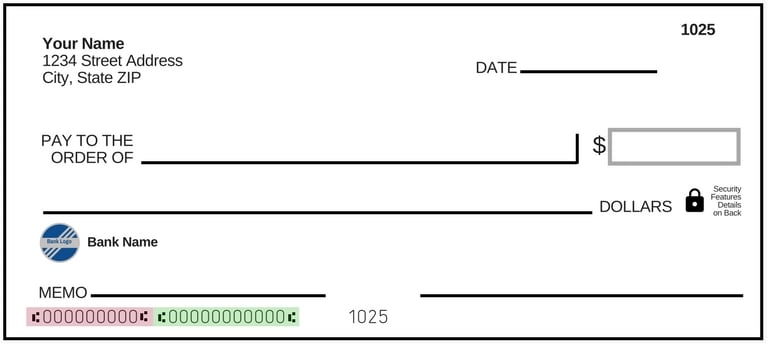

Here’s what your check might look like:

The number you want is in red and is a 9-digit number. The other number, in green, will be your account number. The routing number is always nine digits and you can confirm its validity by using the American Bankers Association Routing Number lookup tool. If you mistype it, the tool will tell you it is an invalid number.

Contact TD Bank for Your Number

If you don’t have a check and can’t remember the state, the last option is to ask TD Bank.

The best way to reach them is to call 1-888-751-9000 and it is available 24 hours a day, 7 days a week. You can also visit a local branch but I suspect calling is faster.

Different Routing Number for Wire Transfers

If you are receiving a wire transfer, it can be domestic or international, you need to know another number. The ABA routing number on your checks is just for ACH transfers, which is a separate system than a wire transfer. A wire transfer is often used when you want to transfer the money quickly and ACH transfers, while free, take a few days to process.

At TD Bank, incoming wire transfers cost $15 for either international and domestic transactions. For outgoing wire transfers, a domestic wire transfer costs $30 and an international wire transfer costs $50. (TD Bank’s full personal fee schedule)

- Domestic wire transfer (Wire Routing Transit Number) – 031101266

- International wire transfer (SWIFT/BIC Code) – NRTHUS33

If you’re receiving a wire transfer, here’s the other information you may need to provide:

| Bank Name | TD Bank, N.A. |

| Bank Address | 6000 Atrium Way Mount Laurel, NJ 08054 (regardless of where your account is located) |

| BNF/Field 4200 Beneficiary acct. # | Your complete TD Bank account number including leading zeros |

| Beneficiary account name and address | The name and address of your account as it appears on your statement |

If you’re going to send a wire transfer, confirm all the details before you send it. In almost all cases, wire transfers cannot be reversed. Always talk to the person you’re going to wire transfer, double-check the details, and confirm them. I’ve heard of a lot of scams that are the result of erroneous wire transfers.

There you have it – an easy way to find your TD Bank routing numbers!