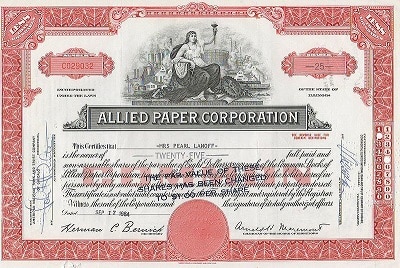

Before I knew anything about investing, I was enamored with stock certificates.

I thought they looked beautiful because they looked like college degrees made to look like money. My dad always had his degree certificates up on the wall in his office but they looked so austere. These stock certificates looked gaudy. They were fantastic.

When I learned that most stocks were digital and physical stock certificates were no longer issued, it made me little sad. I understood why – it’s just not feasible to trade stocks if you had to move the actual paper around. But that early love would translate into an interest in the stock market later on. How could these pieces of paper, which had no intrinsic value much like our fiat currency, be traded for real money?

Now that we have kids, one of the things we’ve learned is that it just takes a spark to capture a young mind’s interest. Like a fire, you need to take that spark and nurture it.

What does this have to do with Stockpile?

Table of Contents

It was started by the CEO, Avi Lele, as a way to gift small amounts of stock to his nieces and nephews. Much like how you could once buy single shares of stock in household names like Coca-Cola, he created Stockpile so you could gift shares and fractional shares of stock via gift cards.

Here’s an interview CEO Avi Lele did with Jim Cramer on CNBC:

What is Stockpile?

Founded in 2010 by Avi Lele and Sanj Kulkarni, Stockpile is a brokerage that lets you buy, sell, and gift fractional shares in over a thousand stocks as well as ADRs and ETFs via gift cards. You can get any stock in the S&P 500 and the minimum purchase amount is $5.

Anyone can buy gift cards and gift them to others.

Only U.S. citizens and residents can open an account. If that person is under 18, say your neice or nephew, they’ll need a custodial account with someone over 18. If that person is over 18, they can go with a regular taxable brokerage account. They don’t support any other types of account, like retirement.

It’s a very hands-on way to introduce young people to the idea of investing. They may be familiar with companies like Apple and Facebook but don’t necessarily have the $160+ it takes to own a single share. You may also want to give a gift to them but not necessarily a $160+ one… so Stockpile enables you to gift fractional shares.

How Does Stockpile Work?

You can gift shares through Stockpile gift cards. They’re issued by Stockpile Gifts and available as physical or e-gift cards.

The fee structure on e-gift cards is similar to gift cards at a store. You pay $2.99 for the first stock plus 99 cents for each additional stock. You also pay a 3% credit or debit card fee on the total price.

If you want to send physical gift cards, there are three set amounts – $25, $50 and $100. The fee ranges from $4.95 to $7.95 depending on the face value of the card:

- A $25 gift card costs $29.95

- A $50 gift card costs $56.95

- A $100 gift card costs $107.95

When the recipient gets the card, they open their account (or deposit it if they already have one) and select what shares they want. They pay no trading fee on this purchase because you’ve already paid for it through the fees on your end.

When the recipient opens an account, they can acquire whatever stock they want. It doesn’t have to match the card.

Stockpile does not offer any penny stocks, pink sheets, foreign ordinaries (most major companies are available as ADRs), or any stocks trading below $6 per share. Their explanation is that “fraudsters often gravitate to these stocks because they’re easier to manipulate due to their low trading volume.” I’m not sure all sub-$6 stocks are targets but it’s a plausible explanation.

Stockpile Fees

The fee structure is straightforward – no monthly maintenance fees and you only pay 99 cents to buy stock with cash. If you pay with a credit card, it’s 99 cents plus a 3% fee to cover the credit card transaction costs. To sell, it’s 99 cents too.

Stockpile Promotion: $5 Free Stock

Want some free cash for signing up to their program? They’re giving out $5 in free stock when you sign up today.

The promotion is straightforward – you can pick any stock you want and you get whatever $5 will get you based on the market closing price that day. If you pick a stock that closes at $50, then you’ll get 0.1 shares (0.1 x $50 = $5). There is no trading commission on this transaction, so you won’t get $5 minus some fee. You get $5 worth of stock.

What’s nice is that since there are no maintenance fees, the $5 free offer is a legitimately $5 free. Also, if you decide you don’t want shares of stock, you can convert it to a retailer gift card for free.

As of November 26th, 2018, Stockpile has ended its free $5 in stock promotion.

Is Stockpile Worth It?

I think the answer to this will depend on what you’re hoping to accomplish.

If you are an investor, Stockpile isn’t for you. Stockpile wasn’t designed for the investor. The 99 cent trades, which seem cheap, are not real-time market trades. They bundle all the customer purchases made before 3 PM and batch them together at the close of the market.

If you want cheap trades, Robinhood will give them to you for free. Plus they run a promotion where you can get free stock from Robinhood if you’re new to them.

Sign up today to get that free share of stock.

If you want to give the gift of stock to a young person to spark their interest in the markets, it’s a great option. No minimums, no fees, and the cost of getting the gift card isn’t that much higher than going to the supermarket.

If you want to introduce young ones to investing, this could be a good way.

GYM says

Cool! We actually just bought a single share of BRK.B for our baby’s first birthday. We bought it from Unique Stock Gift. Haven’t received it yet but looking forward to framing it.