F1 2025's craziest predictions: FIA to fine fans for booing?

The 2024 F1 season was one of the wildest every seen, for on-track action and behind-the-scenes intrigue – James Elson predicts how 2025 could go even further

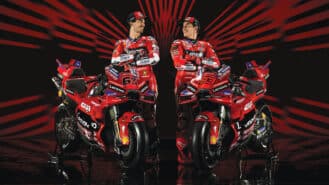

The 77th season of world championship motorcycle racing gets underway at the Buriram racetrack in Thailand over the first weekend of March, with all eyes on one team and two…

Honda says it's struggling with 'technically challenging' 2026 Aston Martin power unit but Newey and Stroll shouldn't worry just yet

Two of racing's biggest rivals are on collision course once more, with the Ford v Ferrari battle for overall Le Mans victory due to resume in 2027 after six decades — and Ford is already talking up the fight

There are many obstacles to preserving truly historic racing cars. The somewhat depressing list of these surely begins with a simple question: define what really constitutes ‘a car’, especially in…

The 2024 season started with the exact same driver line-up as we ended 2023 and frankly that was a bit dull. Fortunately Lewis Hamilton spectacularly kicked off the silly season…

Visitors to Ferrari’s famous HQ in Maranello have in recent weeks noticed an addition to the famous campus. It is a huge 42,500 square metre glass and steel factory building…

Lewis Hamilton goes into his 40s as a new Ferrari driver – here's six reasons the F1 legend still has what it takes to fight at the front

There are many things about the motoring world that I will never, ever, understand. My distaste for most such matters stems from simple disinterest. If it’s a road or production…

Some champions are hard to like. Novak Djokovic is an astonishing athlete, but an acquired taste. Chris Froome in his pomp won the Tour de France four times but left…

Verstappen's prang at the first corner of the F1 finale in Abu Dhabi vindicated George Russell's recent rant

FIA president Mohammed Ben Sulayem seemed intent on making F1 a united front by the end of the 2024 Qatar GP – against him

Leclerc erupted after feeling wronged one time too many by Sainz in Vegas – but the challenge posed by his team-mate next year, Lewis Hamilton, will be much greater writes James Elson

BMW has never tried to win the MotoGP world championship. The German manufacturer made a vague attempt in the 1950s, with a 500cc boxer-twin four-stroke, which took second place in…

As we motor into another winter three variably thought-provoking anniversaries beckon. Seventy-five years ago, on December 15, 1949, a group of national and specialist motoring journalists gathered in rural Lincolnshire…

How important is it to preserve evidence of past racing glories? On this, readers of Motor Sport and I will agree. One of the biggest and best investments we have…

2024 has been Max Verstappen's masterclass – it should go down in history as one of F1's greatest titles